全部新闻

客户挑战

网站组件加载失败,可能是由于浏览器扩展、网络问题或浏览器设置造成的。检查互联网连接、禁用广告拦截器或使用其他浏览器。

伯尼·桑德斯批评人工智能是“人类最重要的技术”

美国参议员伯尼·桑德斯对人工智能 (AI) 的影响日益表示担忧,称其可能是人类历史上最重要的技术。在 CNN 的国情咨文中,他批评科技亿万富翁将利润置于社会福祉之上,并呼吁暂停新的人工智能数据中心。桑德斯警告说,如果没有工作,人们将难以赚取收入或获得医疗保健和住房等基本服务。他还强调了研究表明依赖人工智能聊天机器人来提供情感支持,并提出了此类技术对心理健康和社交互动的长期影响的问题。与此同时,阿拉巴马州共和党参议员凯蒂·布里特 (Katie Britt) 提出立法,旨在保护未成年人免受与人工智能聊天机器人的有害互动,包括对促进这些关系的公司承担刑事责任。两位参议员的言论都反映出两党对人工智能技术治理和监管的罕见关注。

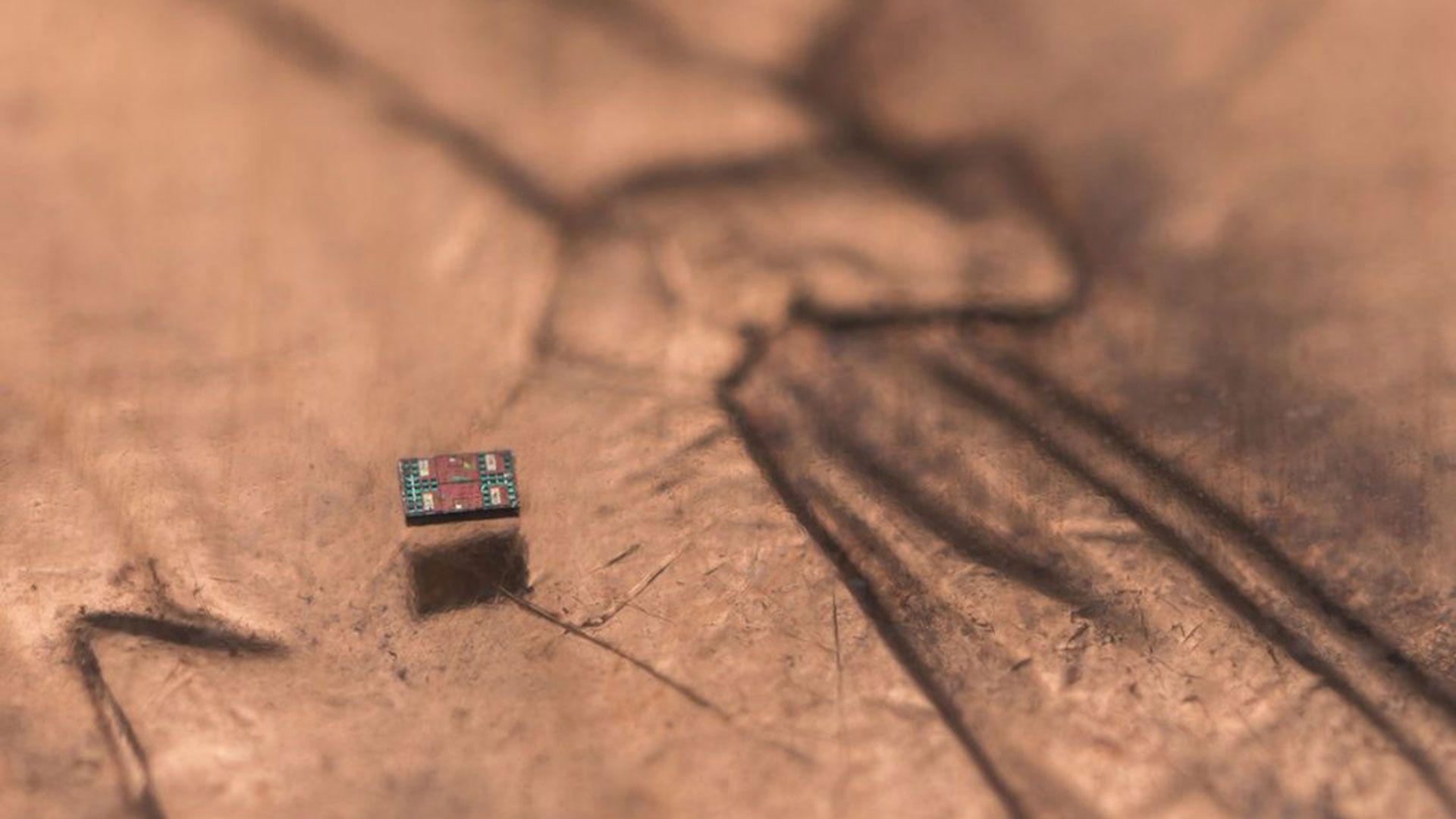

世界上最小的自主机器人“比一粒盐还小”,每个价格一便士——研究人员预计新型微米级完全可编程机器人将用于医学、微型制造和其他领域

宾夕法尼亚大学和密歇根大学的研究人员开发了完全可编程的自主机器人,它们比一粒盐还小,声称它们是世界上最小的机器人。这些纳米级机器人的尺寸约为 200 x 300 x 50 微米,使用离子推进进行运动,并使用太阳能作为能源,使其非常耐用,能够自主运行数月。它们通过基于光的编程系统进行通信,并通过受蜜蜂启发的摇摆舞机制进行数据检索。这些机器人在医学和微型制造方面具有潜在的应用前景,每个机器人的生产成本为一便士。

从鸟人到“公交车阿姨”:超越人工智能的真正社交媒体人物

像 TikTok 这样的社交媒体平台在日常用户中越来越受欢迎,他们分享真实的内容,而不是名人的魅力。从从事园艺的老年养老金领取者到销售烘焙产品的祖母,这些账户已经获得了数百万粉丝,凸显了在线声音向真实、有关联性的转变。这一趋势是由观众对精美的人工智能生成内容的疲劳以及对更有意义的参与的渴望推动的。各个领域的创作者,例如自闭症意识、公共汽车爱好者和退伍军人的生活故事,也越来越受到关注,这表明激情和真实性可以在优先考虑相关性而不是名人地位的社交媒体平台上带来巨大成功。

人工智能即将取代年轻人的办公室工作。这对建筑行业来说是个好消息|基因标记

由于年轻一代更喜欢办公室工作、即将退休的劳动力老龄化以及限制性移民政策等多种因素,建筑行业正面临着技术工人的严重短缺。尽管面临这些挑战,对建筑工人的需求仍在不断增加,特别是在数据中心建设等高需求行业,这些行业的工资大幅上涨。由于该行业的周期性表明未来将出现强劲的复苏期,再加上大流行后人们对职业学校的兴趣日益浓厚,随着越来越多的年轻人认识到这些行业的经济机会,建筑职业的未来看起来充满希望。瓦

迪士尼令人尴尬的人工智能生成的星球大战视频,其中动物被拼凑在一起,这是充满人工智能羞辱的一年的开端

在 4 月份的 TED 演讲中,卢卡斯影业的 Rob Bredow 展示了人工智能生成的《星球大战》内容,但该内容因缺乏创造力和对系列遗产的尊重而受到批评。尽管遭到强烈反对,迪士尼仍继续大力投资人工智能,计划将其整合到 Disney+ 中,并向 OpenAI 投资 10 亿美元,尽管存在滥用其角色的风险。动视暴雪、埃隆·马斯克的人工智能和麦当劳等其他公司也因其使用人工智能而面临批评,这表明在有效利用新兴技术方面面临更广泛的挑战。

英伟达坚称自己不是安然公司,但其人工智能交易正在考验投资者的信心

Nvidia 目前估值超过 4 万亿美元,随着它成为人工智能行业的核心,其商业行为面临着审查。批评人士对与 OpenAI 和 CoreWeave 等公司的循环交易表示担忧,英伟达在这些公司投资了数十亿美元来确保芯片采购,这与安然和朗讯等过去失败的企业进行了比较。尽管英伟达否认,但如果人工智能增长放缓,人们担心这种安排的可持续性。此外,与政府和国家的不透明协议为其金融稳定性增加了更多不确定性。氮

人工智能关系真的对我们有好处吗?

人们越来越担心人与人工智能关系的风险,包括有关聊天机器人互动造成伤害的报告以及越来越多的年轻人接受人工智能陪伴。然而,还必须考虑潜在的好处,例如减少孤独感和辅助心理治疗。虽然健康的非人类关系很常见,但人工智能模仿人类思维和情感的能力引起了人们对妄想和成瘾的独特担忧。在将人工智能用于公共利益之前,需要进行研究以了解风险和收益,确保其避免有害的阿谀奉承并促进现实世界的社交技能。时间

OpenAI 首席执行官 Sam Altman 刚刚公开承认人工智能代理正在成为一个问题;说:人工智能模型开始发现...... - 印度时报

OpenAI 正在以 555,000 美元的价格聘请一名准备主管,以解决与 AI 发现安全缺陷和心理影响的能力不断增强相关的网络安全、生物安全和心理健康影响。首席执行官萨姆·奥尔特曼(Sam Altman)在对人工智能驱动的网络威胁和心理健康问题的担忧中宣布了这一职位。这一立场是在最近有关人工智能危害的诉讼和报告之后做出的,这标志着 OpenAI 安全方法的转变。职责包括制定关键领域的风险评估和缓解措施。此次职位空缺是在 OpenAI 安全团队领导层发生变动之后发生的。

AI 预测 2026 年底标准普尔 500 指数价格

尽管市场波动,标准普尔 500 指数在 2025 年还是成功的一年,创下了多个历史新高。到 2026 年,由于大型科技公司继续占据主导地位,预计该指数将达到 7,000 点的里程碑。截至周五收盘,标准普尔 500 指数估值为 6,929 点,年初至今上涨超过 18%。ChatGPT 预测,到 2026 年底,该指数的基本情况预测约为 7,600,这意味着基于稳定的盈利增长和逐步宽松的货币政策,涨幅约为 10-12%。看涨前景表明,在有利的条件下,价格可能会达到 8,300 至 8,500 点;而看跌前景则预测,如果出现持续高通胀或经济衰退,则价格区间将在 6,500 至 6,800 点之间。