Artificial intelligence (AI) has been a key theme that has been influencing the U.S. stock market, especially since the success of OpenAIâs ChatGPT. The emergence of Chinaâs DeepSeek has triggered concerns about the huge investments involved and the competition in the generative AI space. While elevated valuations of AI stocks and expected returns on massive investments continue to be scrutinized, the huge growth opportunities make several companies in the AI sector attractive. Using TipRanksâ Stock Comparison Tool, we placed C3.ai (AI), Super Micro Computer (SMCI), and SoundHound AI (SOUN) against each other to pick the AI stock that could generate the highest upside, according to analysts.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanksâ Stock Screener.

C3.ai (NYSE:AI)

C3.ai offers enterprise AI software that enables digital transformation. The companyâs products are seeing growing adoption, with Q2 FY25 marking the seventh consecutive quarter of accelerating revenue growth. Interestingly, in November 2024, C3.ai announced an expanded partnership with Microsoft (MSFT), under which Microsoftâs Azure will be its preferred cloud provider. The company expects this collaboration to accelerate the adoption of its AI software.

Meanwhile, AI stock has fallen more than 17% so far in 2025, but is still up about 9% over the past year. Continued losses and elevated valuation have impacted investor sentiment. Significant investments to expand the product portfolio and marketing expenses are weighing on C3.aiâs bottom line.

C3.ai is scheduled to report its results for the third quarter of Fiscal 2025 on February 26. Analysts expect the companyâs Q3 FY25 revenue to grow by 25% year-over-year to $98.5 million. However, loss per share is expected to increase to $0.25 per share from $0.13 per share in the prior-year quarter as the company continues to make growth investments.

Is C3.ai Stock a Buy, Sell, or Hold?

There have been no analyst ratings on SOUN stock so far this year. Back in December 2024, analysts at KeyBanc and JPMorgan downgraded C3.ai stock to Sell from Hold. In particular, JPMorgan analyst Pinjalim Bora downgraded C3.ai stock, citing its financial performance, uneven growth, and thin margins. The five-star analyst noted that while C3.ai recently improved its revenue growth, there are concerns over the high costs associated with this improvement.

Overall, Wall Street is sidelined on C3.ai stock, with a Hold consensus rating based on four Holds, two Buys, and four Sells. At $37.22, the average AI stock price target implies about 31% upside potential.

Super Micro Computer (NASDAQ:SMCI)

Super Micro Computer offers application-optimized server solutions and is considered a beneficiary of the ongoing AI wave. SMCI stock has been on a roller coaster ride. It has rallied about 73% in the past month but is still down nearly 24% over the past year. Accusations by Hindenburg Research, growing competition, accounting issues and the resultant delay in the filing of financial statements, and the threat of a delisting from the Nasdaq exchange have impacted SMCI stockâs movement over the past year.

Optimized with Nvidiaâs (NVDA) GPUs (graphic processing units), SMCIâs servers are designed for AI, deep learning, and high-performance computing. In the press release for the Q2 preliminary results, SMCIâs CEO and founder Charles Liang stated that with the beginning of the companyâs transition from Nvidiaâs Hopper to Blackwell GPUs, the growth in new generation platforms is expected to accelerate as supply ramps in the current quarter and beyond.

Further, Liang is confident that SMCI will file its delayed annual report by the U.S. Securities and Exchange Commissionâs (SEC) deadline of February 25 and expects the company to hit $40 billion in revenue in FY26. The CEOâs optimistic statements overshadowed the lower-than-expected preliminary Q2 numbers and weak full-year outlook.

Is SMCI Stock a Good Buy?

On February 21, Goldman Sachs analyst Mike Ng increased the price target for Super Micro Computer stock to $36 from $32 and reiterated a Hold rating. The analyst noted that the companyâs preliminary Q2 EPS was on the low end of guidance, reflecting a revenue and gross margin miss, mainly due to the ongoing transition from Hopper to Blackwell GPUs.

On the positive side, Ng noted that SMCI has raised $700 million in new financing and expects to continue to raise capital in order to support working capital requirements for its FY26 $40 billion revenue target. The company believes it has sufficient production capacity to support its top-line outlook once components become available.

Overall, Wall Street has a Hold consensus rating on Super Micro Computer stock based on three Buys, two Holds, and two Sell ratings. The average SMCI stock price target of $37.17 implies about 34% downside risk.

SoundHound AI (NASDAQ:SOUN)

SoundHound AI has emerged as a prominent player in the conversational AI space, with over 200 enterprise brands leveraging the companyâs AI agents across several verticals like automotive, restaurants, retail, healthcare, and financial services.

It is worth noting that SoundHound stock gained popularity when it was revealed that semiconductor giant Nvidia purchased the companyâs shares in Q4 2023. However, SOUN stock plunged 28% when recently an SEC filing indicated that Nvidia liquidated its position in the AI-powered voice technology company.

Despite this unfavorable development, SoundHoundâs prospects look attractive as the company continues to win more customers across existing and new end markets with its innovative offerings. SoundHound is scheduled to announce its Q4 2024 results on February 27. Analysts expect the company to report a Q4 loss per share of $0.10 compared to a loss per share of $0.07 in the prior-year quarter. Wall Street expects fourth-quarter revenue of $33.73 million, reflecting a more than 97% year-over-year growth.

Is SoundHound Stock a Good Buy?

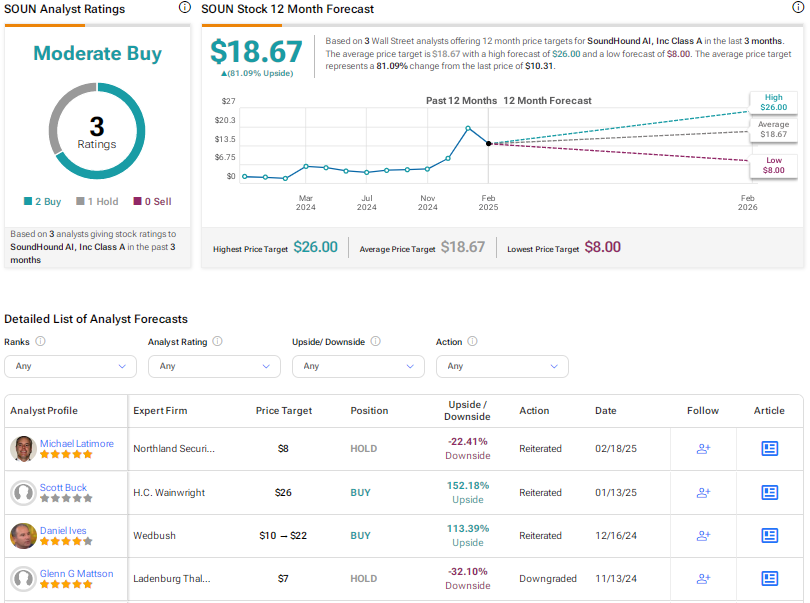

Recently, H.C. Wainwright analyst Scott Buck reiterated a Buy rating on SOUN stock with a price target of $26 following a meeting with the companyâs management at the 2025 Consumer Electronic Show in Las Vegas.

The analyst noted that management demonstrated multiple AI product use cases in automotive, restaurant, and call management services. Buck highlighted SOUNâs voice commerce ecosystem that allows SoundHound-enabled automobiles to connect directly with SoundHound-enabled restaurants. While still in the initial phase of development, Buck sees multiple potential avenues of monetization for the voice commerce ecosystem through a percentage of ticket sales, a flat fee, or a convenience fee charged to customers. With about 10 million SoundHound-enabled automobiles on the road in North America, management believes that partnering with auto manufacturers could generate $500 million annually.

Buck believes revenue opportunities, like the voice commerce ecosystem, could drive meaningful top-line growth and push SoundHound stock higher.

Wall Street has a Moderate Buy consensus rating on SoundHound stock based on two Buys and one Hold recommendation. The average SOUN stock price target of $18.67 implies 81.1% upside potential. SOUN stock has rallied over 173% in the past year.

Conclusion

While the three companies discussed above are seeing higher business due to AI tailwinds, there are concerns about consistency in demand amid growing competition and whether Big Tech would continue to spend heavily on AI. Wall Street is sidelined on C3.ai and Super Micro Computer stocks due to company-specific risks and is cautiously optimistic about SoundHound stock. Currently, analysts see higher upside potential in SoundHound stock.