Taiwan Semiconductor Stock: AI Growth Amid Geopolitical Risk

Despite their leadership, AI stocks like Taiwan Semiconductor and Nvidia are flat year-to-date and trading at similar levels as June 2024. Clearly, the AI trade is not as straightforward as it might seem. Taiwan Semiconductor, in particular, sits at the center of geopolitical tensions — yet those tensions tend to surround companies with deep IP in the AI economy. What makes this economy so distinct is not just the extraordinary commercial demand, but also its rare, historical role in shaping global alliances (and adversaries).

Investors are confronted almost daily with friction between the U.S. and China — and at the center of it all is one stock: Taiwan Semiconductor (TSMC). While enthusiasm around AI demand remains strong, assuming it will simply override geopolitical headwinds is overly optimistic. Onshoring a supply chain like TSMC’s takes years, yet markets can react to a negative headline in seconds.

Headlines aside, the bigger picture is that TSMC is deepening its moat with advanced nodes, such as N2 and A16. The company already powers tens of trillions in market cap on the stock market when you consider Apple, Nvidia, Broadcom, Amazon, AMD and Google are customers of TSMC. Essentially, all mega cap stocks have an AI strategy spanning merchant GPUs and custom silicon, and of course, software – yet the common denominator to these strategies is they all funnel into TSMC.

The problem my firm helps with is this -- how does an investor ride out the inherent cyclical nature of semiconductors given the powerful, secular trend of AI? For every stock that becomes a multi-generational winner, there are dozens that never reclaim their all-time highs. The cloud sector for example, is becoming an all-time high graveyard with once-upon-a-time Wall Street darlings trading meaningfully below their ATHs for over three years now.

TSMC will very likely push beyond its ATH yet returns can increase meaningfully if an investor has the guts to buy during a steep selloff. Other times, that selloff isn’t coming and it’s best to buy before a breakout. We answer these complex questions in the analysis below.

TSMC’s Advanced Nodes have Created a Competitive Moat

The most advanced node shipping today is the 3nm, offering 15% better performance than the 5nm process when power level and transistors are equal. The die sizes are an estimated 42% smaller than the 5nm and TSMC also states the 3nm process can lower power consumption by as much as 30%.

Power efficiency is a major advantage, helping to deepen TSMC’s moat. Samsung was first to introduce 3nm process chips in 2022 yet has not been as competitive on yield and power efficiency at a roughly 10% to 20% difference compared to TSMC. The moat is visibly seen in TSM’s pricing power with the dominant foundry charging 25% more for its 3nm process compared to its 5nm process, and customers are willing to forego Samsung to pay the higher pricing.

Last year, companies such as Apple, Nvidia, AMD and Intel committed to working with TSMC for its 3nm process, and eventually Google and Qualcomm left Samsung “after careful consideration” to also secure a partnership with TSMC.

This was an important moment for TSMC to complete its near-monopoly in advanced nodes as Google had been outsourcing its Tensor processors to Samsung’s foundry for four generations, before moving to TSMC for the fifth generation. Qualcomm also switched to TSMC from Samsung for the Snapdragon 8 Gen 4 series.

To attract these large customers with different end markets, TSMC offers a few 3nm processes, such as the N3E, N3P and N3X. This allows a company like Apple to customize the 3nm chips differently than AI chips for hyperscalers. N3E is the baseline for IP design with 18% increased performance and 34% power reduction, N3P has higher performance and lower power consumption, whereas the N3X will offer high-performance computing very high performance but with higher power leakage.

To illustrate the near monopoly that TSMC has over other foundries, consider that its market share stands at 67.1%, up 2.4% QoQ in Q4. Meanwhile, second-place Samsung was at 8.1% down from 9.1% for a lead of 59 points.

When comparing revenue, TSMC reported $26.85 billion in Q4 for a 14.1% increase compared to Samsung’s $3.26 billion, which declined 100 basis points to 8.1%.

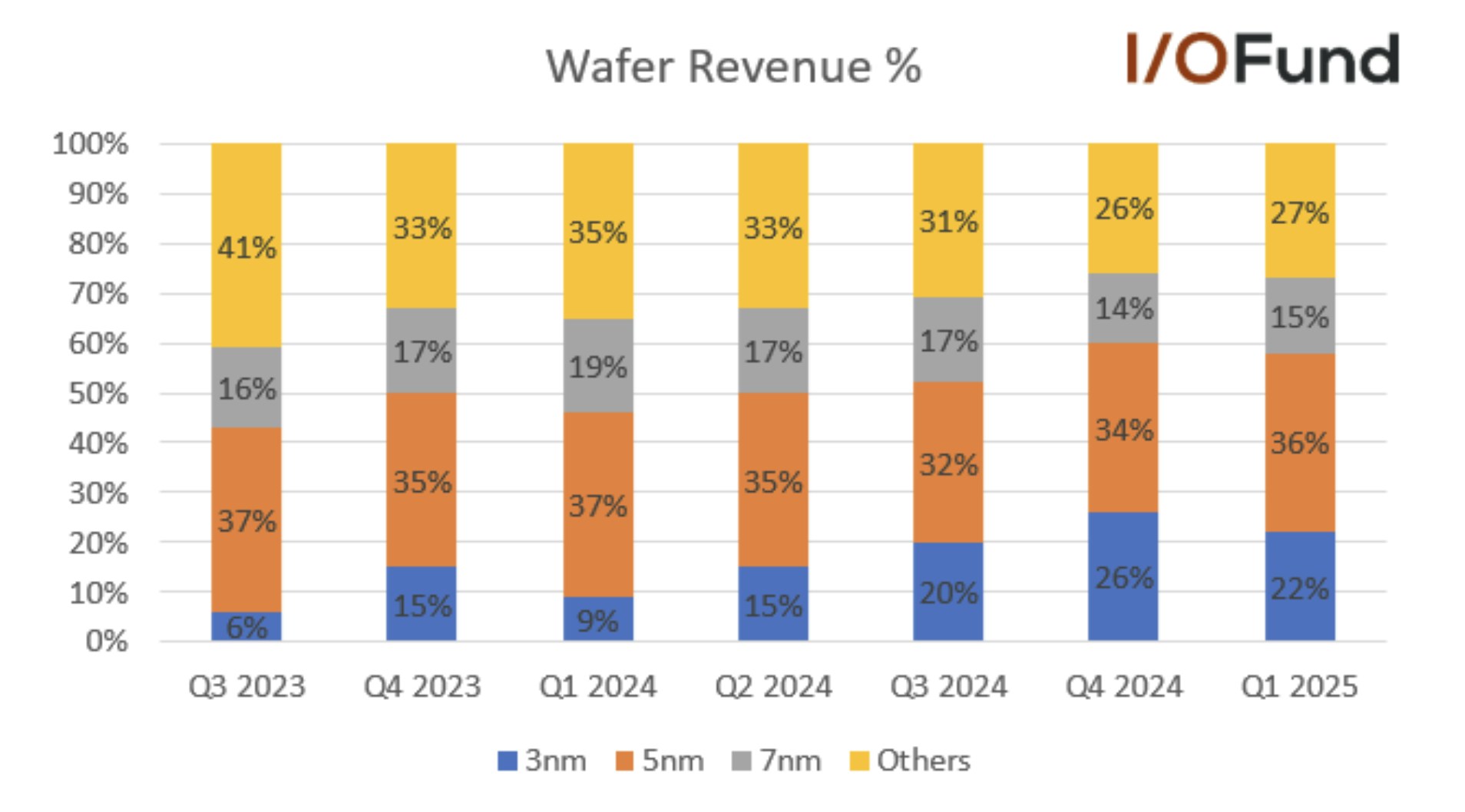

In the latest quarter, advanced nodes below 7nm drove 73% of wafer revenue with 3nm contributing 22% of revenue and 5nm representing 36% of revenue. Nvidia is not on the 3nm process yet for its Blackwell shipments, thus 5nm is outsized in terms of its market share.

Pictured Above: 3nm revenue for TSMC has ramped quickly, up from 9% in the year ago quarter and in its third consecutive contributing >20% of revenue.

TSMC’s 2nm Nanosheet Transistors (Gate All-Around)

Looking ahead, 2nm is expected to see volume production in the second half of 2025 with a more advanced iteration called N2P scheduled for volume production in the second half of 2026. The 2nm marks a new era in TSMC's transistor architectureas N3 relied on FinFET while gate-all-around (GAA) is being introduced for N2. As the name implies, the gate is wrapped around on all sides compared to FinFET which had a gate wrapped on three sides. By having the gate wrap “all-around,” a greater surface is created for better electrostatic control and to also reduce leakage.

For TSMC, the 2nm will feature NanoFlex technology, which is similar to FinFlex to where designers can use cells from different libraries. However, due to the new gate-all-around (GAA) nanosheet transistors, there are additional benefits, such as customizing the width and height of cells. For example, GAA can uniquely widen the channels for a performance boost, or there is an option to narrow the channel to optimize power cost. The goal is to increase the performance-per-watt to enable higher levels of output and efficiency.

According to management on the earnings call: “N2 will deliver full-node performance and power benefits with 10% to 15% speed improvement at the same power or 20% to 30% power improvement at the same speed and more than 15% chip density increase as compared with N3E.”

Similar to the 3nm, there will be a few variants of the 2nm chip for customers to optimize performance with power requirements. The first two years of the 2nm ramp is outpacing the 3nm and 5nm ramp, signaling good things to come for TSMC.

TSMC Stock will Close out the Decade with Pricing Power

As a growth investor, it certainly doesn’t hurt to keep an eye on the horizon. A16 is the 1.6nm process node that will emphasize backside power delivery. Our firm first covered this topic last year in the analysis: “Taiwan Semiconductor Stock: April Sales Soar From Advanced Nodes" stating the Angstrom era will translate to “future process generations where the nodes are not smaller necessarily, rather the transistors they’re built with will be improved upon.”

For the A16, the Super Power Rail (SPR) backside delivery will offer a redesign to where power routing is moved from the front to the back, which allows for the signaling on the front side to have lower latency. By reducing voltage drop, SPR becomes attractive for AI workloads since multiple cores are operating at high speeds with complex signal routes and dense power requirements.

Intel’s PowerVia is first to market with the backside power delivery design, yet TSMC’s design will likely result in higher yields and volume production. TSMC also connects the backside power delivery to each transistor’s source and drain, which is more expensive yet also more efficient compared to Intel’s approach.

The A14 is due out in 2028 and will offer a significant breakthrough in performance while offering up to 25% to 30% lower power consumption, with increased density of 20% to 23%. There will be an A14 variant that offers backside power delivery in 2029. It's expected that A14 will help to drive forward edge AI due to a combination of speed improvements and power reduction. Pricing for the A14 is expected to increase from $30,000 per wafer for the 2nm process to $45,000 per wafer as we close out the decade.

TSMC to Grow Revenue Mid-20%; AI Accelerator Revenue will Double

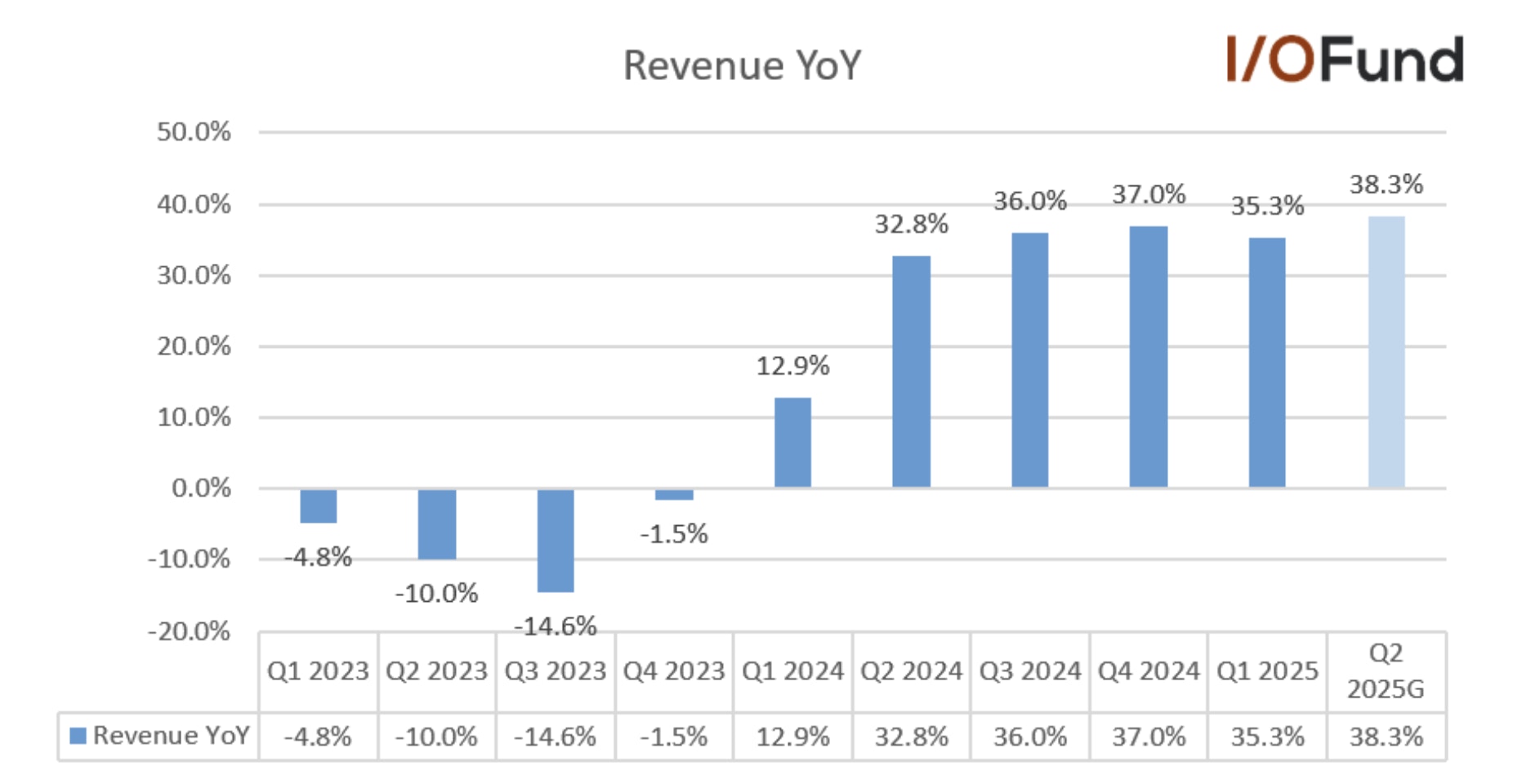

The company is off to a good start for the year with revenue growth of 35.3% YoY while guiding for an acceleration to the 38% range in Q2. Revenue was down (5.1%) sequentially, impacted by smartphone seasonality, partially offset by AI-related demand growth. However, the Q2 guide represents 13% QoQ growth with revenue between $28.4-29.2 billion.

TSMC offers monthly reports with April starting Q2 off strong as monthly revenue surged 48.1% YoY and 22% MoM to ~$11.55 billion, with Bloomberg stating the outperformance could be due to a rush in pre-tariff ordering, although certainly 3nm and 5nm demand helped as well.

TSMC earnings show strong growth in H1 followed by lower growth in H2.

This year, IDC is forecasting Foundry 2.0 will grow by 11% compared to 6% last year. Foundry 2.0 describes a broader range of foundry technologies, with the foundry segment expected to grow 18% down from 20% last year.

Regardless of which way you dice it, TSMC is guiding for above industry growth, stating in the most recent quarter: “we continue to expect our full-year 2025 revenue to increase by close to mid-20s percent in U.S. dollar term.”

Of this, AI accelerator revenue is expected to double in 2025 and management also forecasts AI to grow at a mid-40% CAGR for five years from 2024: “Based on our planning framework, we are confident that our revenue growth from AI accelerators will approach a mid-40s percentage CAGR for the next five years period starting from 2024.”

Slower Growth Up Ahead with H1 > H2

An area of concern is that TSMC is guiding a slowdown in the second half of the year, given the mid-20% revenue growth is below Q1/Q2 revenue growth of 35% to 38%.

There was a question on the call about this from analyst Charlie Chan asking: “And also based on your full-year guidance, so called the mid-20%, it seems like second half recovery will be very, very gradual or flattish. So I'm wondering if you're already bake in kind of consumer tech demand impact. And if a tariff have some kind of turnaround, right, meaning, for example, major smartphone brands whether there's a chance for you to revise your full-year revenue guidance? Thank you.”

Management answered the H2 weak guide is due to uncertainty and tariffs: “Charlie, as we also said in the prepared remarks, there are uncertainties and potential risk from tariffs exist.”

Analysts are a bit concerned about the full-year guide given the risks key customers are facing from April’s tariff shocks. JPMorgan analysts say TSMC “could pare [its forecast] slightly to target low- to mid-20%” sales growth, while Deutsche Bank analysts raised the concern that the chipmaker “may also withdraw its guidance as customers adjust to tariffs.”

Management also stated that things are more “balanced now” -- meaning demand is not overwhelming supply like it once did: “Brett, three months ago. Now I can tell you that three months ago, we are barely – we just cannot supply enough wafer to our customer. And now it's a little bit balanced, but still the demand is very strong. And you are right. Other than China, the demand is still very strong, especially in U.S. And so we are confident that we are going to double our AI revenue this year.”

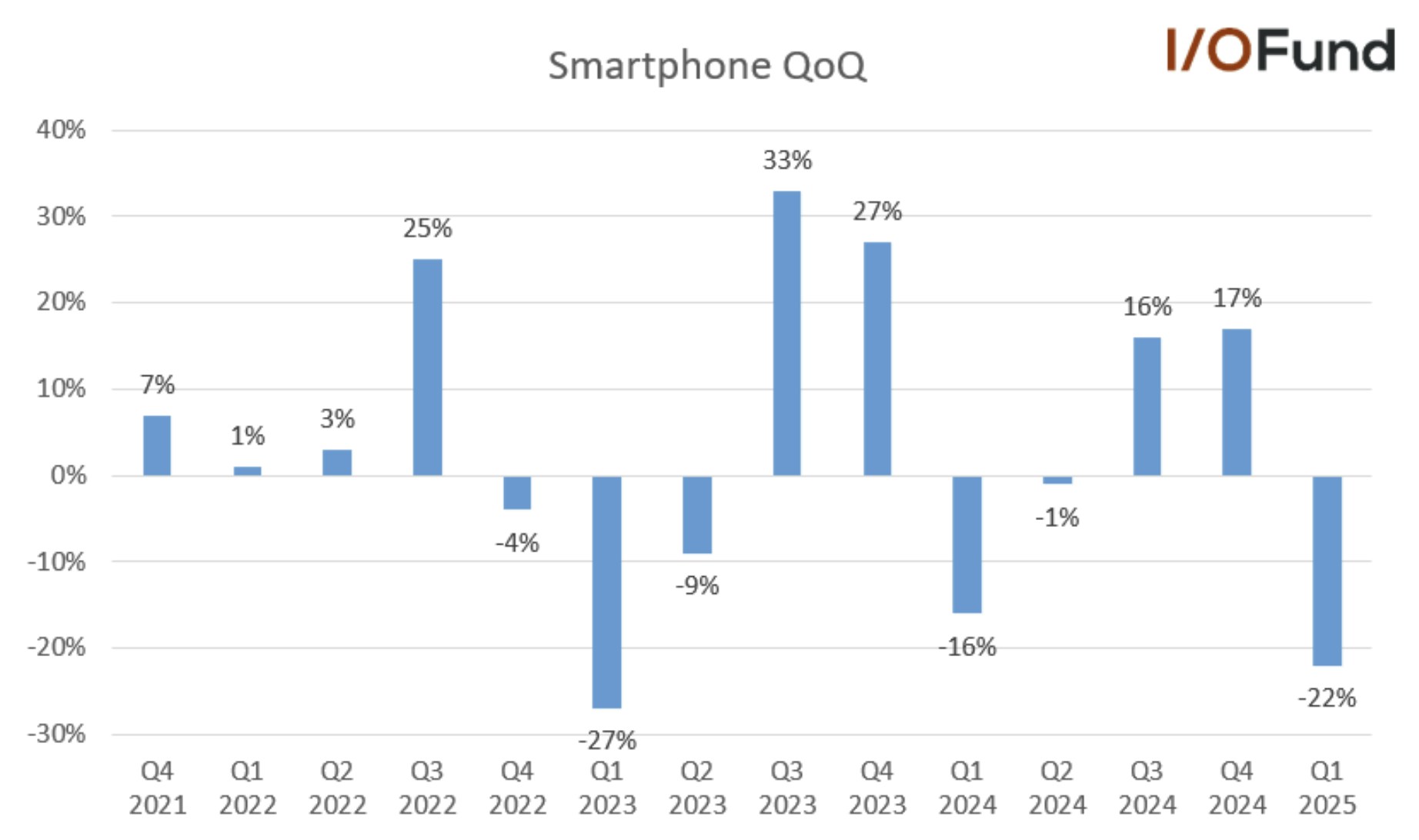

Echoing these comments, if we look at the segments listed below, we can see that smartphones are reporting higher seasonal weakness than last year.

TSMC Reports Strength in HPC offset by Smartphones

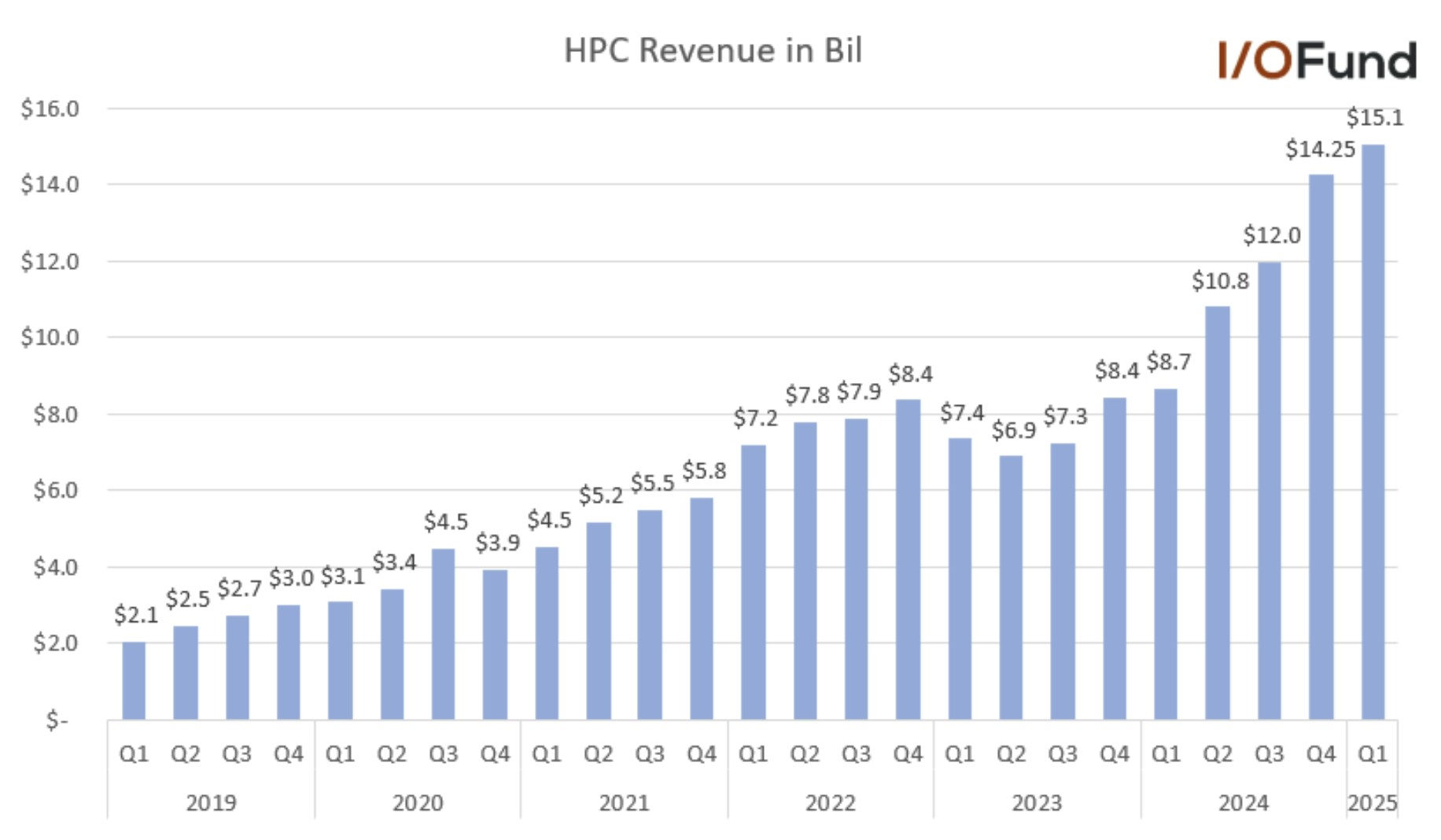

HPC Revenue rose 7% QoQ

TSMC continues to ride AI accelerator tailwinds, evident in its rising HPC revenue and mix. HPC revenue rose 7% QoQ in Q1, surpassing $15 billion for the first time. HPC accounted for 59% of TSMC’s revenue, expanding from 53% of revenue last quarter.

Pictured above: Major tech companies choose TSMC for AI chips, visible in its HPC segment

Management stated that they “continue to observe robust AI-related demand from our customers,” and reaffirmed that AI accelerator (GPU + ASIC + HBM) revenue is expected to double YoY in 2025. As stated, management also confidently forecast AI accelerator revenue to grow at a mid-40% CAGR over the next five years starting in 2024.

Smartphones Declined 22% QoQ:

Smartphone revenue declined (22%) QoQ due to seasonal trends, accounting for 28% of revenue in Q1. This was larger than last year’s (16%) seasonal decline.

TSMC is reporting higher seasonal weakness in the smartphone segment compared to last year.

IoT, Auto and Other:

IoT revenue declined (9%) QoQ to account for 5% of revenue, while Automotive revenue increased 14% QoQ to also account for 5% of revenue. Digital Consumer Electronics increased 8% QoQ to account for 1% of revenue, while Other revenue rose 20% QoQ to account for 2% of revenue.

Gross Margin to See 3% to 4% Headwind

Margins came in at the higher end of guidance in Q1, with TSMC seeing continuing strength in Q2.

- Gross margin was 58.8%, at the high end of management’s guided range for 57-59%, dipping slightly sequentially from the January earthquake impacts and the ramp of the Kumamoto fab. On a YoY basis, gross margin expanded 5.7 points.

- Operating margin was 48.5%, at the high end of the guided 46.5-48.5% range.

- Net margin was 43.1%, flat with Q4 and up 3.1 points YoY.

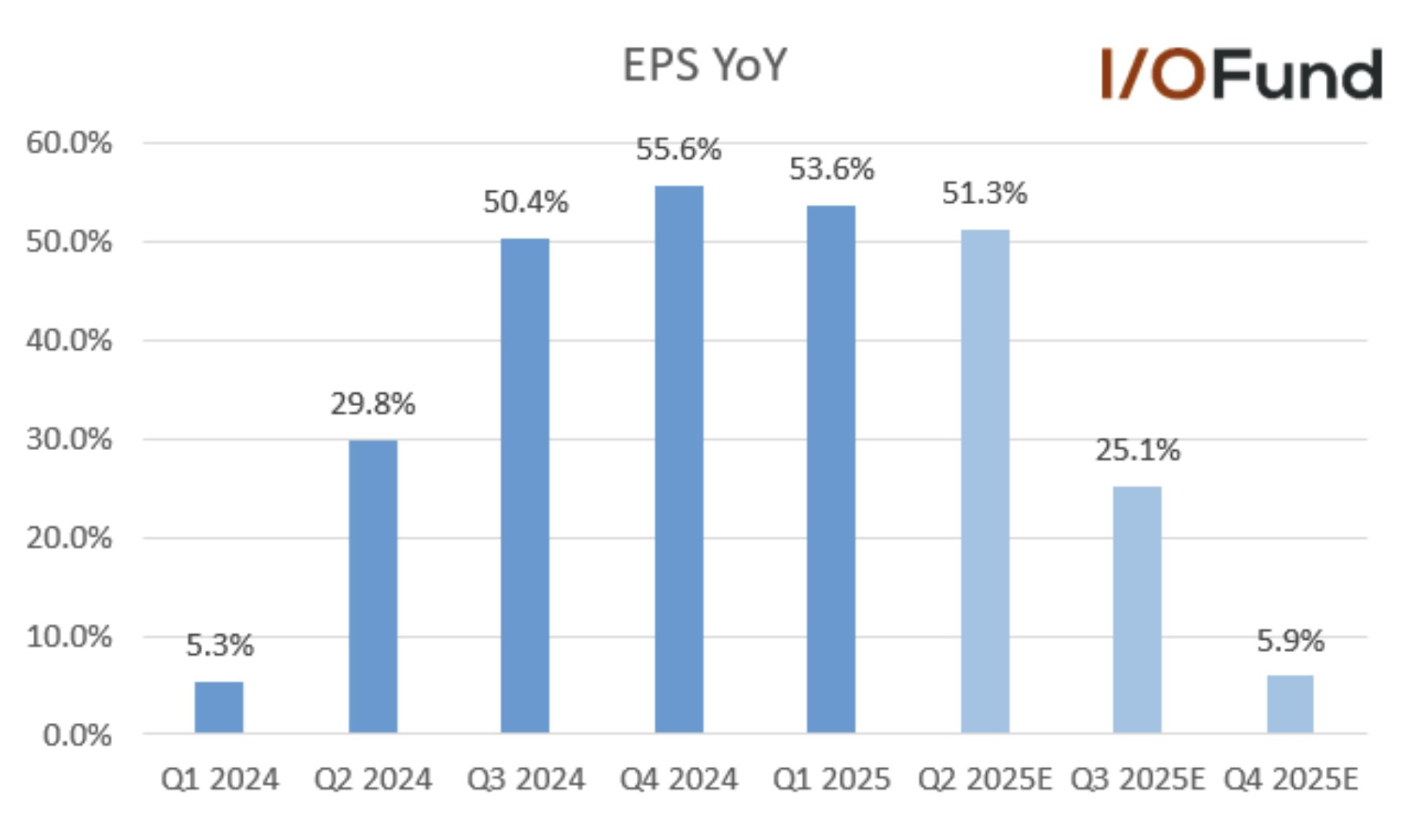

TSMC delivered nearly 54% YoY growth in EPS in Q1 as it delivered a slight beat to $2.12, its third straight quarter with EPS growth above 50% YoY. This growth also reflects TSMC’s operating leverage, outpacing revenue growth in the mid to high-30% range.

In Q1, TSMC reported strength on the bottom line with EPS growth of 53.6% although EPS will face tough comps with growth plateau’ing toward the end of the year.

For Q2, EPS growth is expected to maintain this >50% growth rate to $2.24, before decelerating rather sharply to the mid-single digits by Q4 as it begins to lap these more difficult 50% growth comps.

FY25 EPS is currently expected to increase 31.5% YoY to $9.26, before decelerating to 15.2% growth in FY26 to $10.66.

For Q2, TSMC guided for similar gross and operating margin ranges, but flagged some headwinds from the fabs buildout. However, a larger headwind exists – FX. TSMC’s guidance below assumes an exchange rate of US$1 to NT$32.5, yet the current rate sits at US$1 to $NT30.1, down nearly 8% from the guided level.

- Gross margin is forecast at 57-59%, down 0.8 points sequentially at midpoint as dilutive impacts from ramping the Arizona fab kicks in. Management added that overseas fab impacts are expected to grow more pronounced throughout the year, forecasting 2-3% dilutive impact for the full year from Arizona and Kumamoto.

- Operating margin is forecast at 47-49%, down 0.5 points sequentially at midpoint.

Over the next five years, management sees the dilutive impact from ramping its overseas fabs widening, projecting it to start at 2-3% each year in the early ramp stages before widening to 3-4% each year. Despite this, TSMC remains confident in its ability to keep long-term gross margins at 53% or higher.

$100B Investment Announced for Arizona Fabs

In the recent quarter, the company’s cash flow increased 37% YoY to $19.0 billion, for a 74.5% margin, a slight YoY expansion. Capex was $10.1 billion in Q1, down more than 10% QoQ but up more than 74% YoY. Cash and equivalents rose $7.5 billion sequentially to $81.4 billion, while debt is $30.4 billion.

In March, TSMC announced a new $100 billion investmentto expand manufacturing in the United States. The $100 billion will go toward building new fabs in Arizona bringing TSMC’s total investment in the United States to $165 billion. Once the new fabs are built, 30% of TSMC’s advanced nodes capacity will be located in Arizona.

TSMC’s current Arizona fabs began producing chips this year, with Apple being the first to receive chips on the 4nm/5nm process and Nvidia receiving chips later this year. In addition, it’s been reportedthe 2nm process is seeing a 90% yield for memory products in the newer Arizona fab.

Notably, due to rising costs, there are rumors that TSMC will raise prices from the Arizona fab by 30%.

Subscribe for Full Access to the Article

Below the Paywall is the Following information

- Our analysis on the stock’s valuation and if the stock is a “buy” or a “hold” given the stock faces immense demand from the AI economy yet must also weather geopolitical tensions.

- The I/O Fund’s trading plan for TSMC including never-before published buy targets over a 12 to 18-month time frame.

Sign Up to Continue Reading

Paid subscribers, click here to view the full article

Not ready to subscribe but want more thoughtful analysis from a top-performing team in tech? Every week, we publish free research. 👉 Sign up here.

For any account-related issues, please contact our customer support team at premium@io-fund.com.

Disclaimer: This is not financial advice. Please consult with your financial advisor in regards to any stocks you buy.

Recommended Reading:

- Historic Market Uncertainty Meets $7 Trillion Debt Wall: What Comes Next for the S&P 500

- Nvidia Stock Faces a Choppy Q2, But Tailwinds Build for H2 Acceleration

- Microsoft Stock Surges After Q3 2025 Earnings: What Separates Azure from AWS, Google Cloud

- Tesla Stock Faces Recalibration of Growth Expectations

关于《Taiwan Semiconductor Stock: AI Growth Amid Geopolitical Risk》的评论

发表评论

摘要

相关讨论

- Global Neck Cream and Mask Sales Market Surges with Demand for Targeted Skincare Solutions and Anti-Aging Innovations

- Global Recycled Polyester Staple Fiber Market Booms Amid Growing Demand for Sustainable Textiles

- 新西兰不为人知的另一面:分享一个有关留学和移民失败的案例

- 康师傅黑了900亿 路透新闻, 大家知道了吗?

- 在新加坡做面试官的经历 (Interviewer Experience for UI/UX Designer in Singapore)