ALAI: High Reward So Far For Artificial Intelligence Exposure (NYSEARCA:ALAI)

![]()

Summary

- ALAI offers concentrated, growth-focused AI exposure, ideal for investors seeking active management beyond core index ETFs.

- I rate ALAI a Buy for those comfortable with its short track record and the fee hike risk after 2026.

- The ETF's top holdings, notably Nvidia, have driven recent outperformance versus other AI-themed ETFs since April 2024.

- Investors should weigh ALAI's high concentration, fee structure, and ability to outperform broader tech and S&P 500 ETFs over time.

Shutthiphong Chandaeng

Introduction

Always in the hunt for actively managed funds to compliment my "Core" index-based ETFs, I came across the Alger AI Enablers & Adopters ETF (NYSEARCA:ALAI), which also had not been covered on Seeking Alpha yet. Being

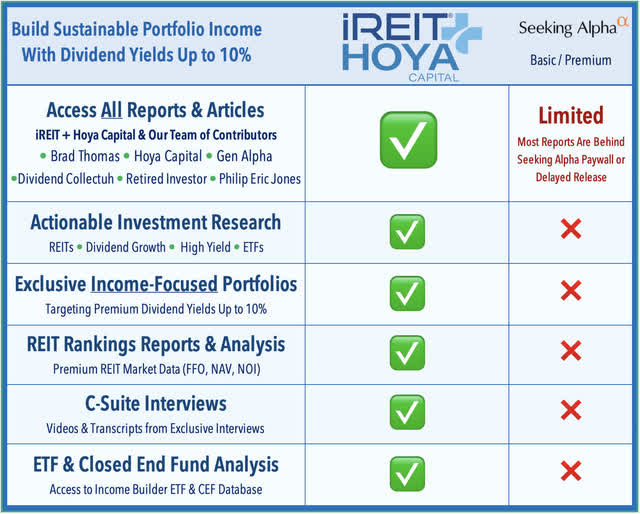

Read The Full Report on iREIT®+Hoya

iREIT®+HOYA Capital is the premier income-focused investing service on Seeking Alpha. Our focus is on income-producing asset classes that offer the opportunity for sustainable portfolio income, diversification, and inflation hedging. Get started with a Free Two-Week Trial and take a look at our top ideas across our exclusive income-focused portfolios.

With a focus on REITs, ETFs, Preferreds, and 'Dividend Champions' across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.

Analystâs Disclosure:I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.