AI boom warning sign? Nvidia's new chips hit data center cooling stocks

作者:By Steve Kopack

In a possible red flag for the artificial intelligence investment boom, the stocks of companies that provide cooling systems for data centers, plunged Tuesday after Nvidia unveiled more efficient chips.

Shares of Johnson Controls slid 6.2%, while shares of Modine Manufacturing plunged more than 7.4%. Trane’s stock fell 4%, and Carrier Global’s also dipped nearly 1%.

All of those companies sell industrial cooling systems to sprawling data centers, which tech companies are spending tens of billions of dollars to build and expand around the world as part of the AI investment wave.

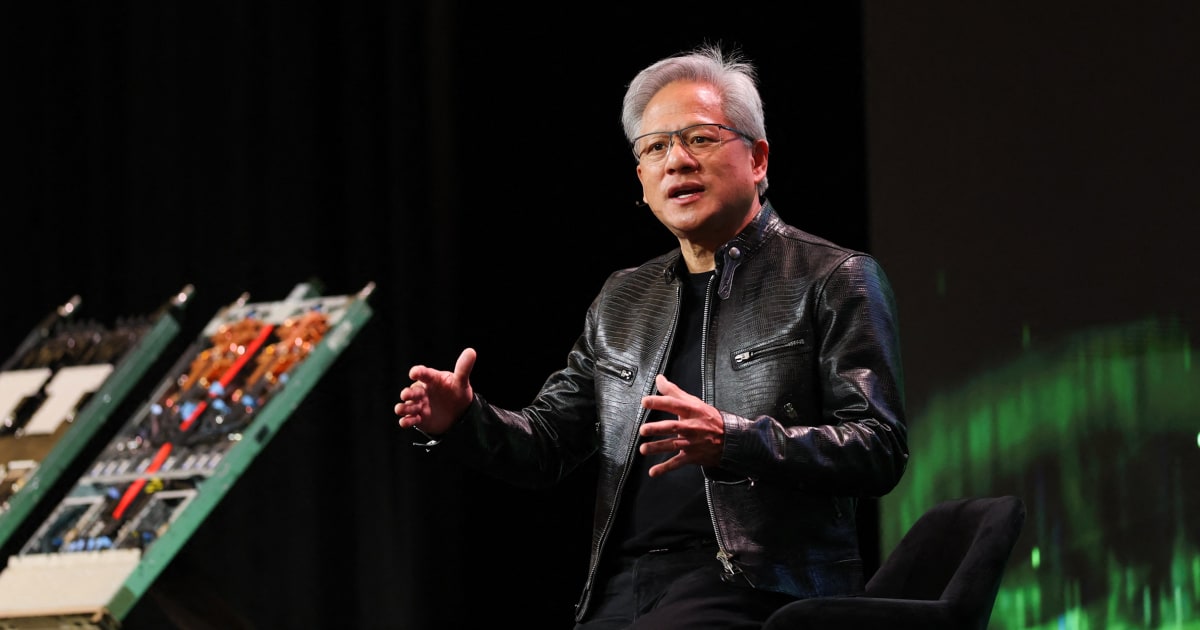

Nvidia’s chips are a major driver of the AI revolution. CEO Jensen Huang told attendees at the Consumer Electronics Show in Las Vegas that the company’s next-generation Vera Rubin chips will not require chiller systems to cool the water that keeps the high-powered AI chips at an appropriate operating temperature.

“The power of Vera Rubin is twice as high as Grace Blackwell,” Huang said, referring to the current Blackwell generation of Nvidia chips. “And yet, and this is the miracle, the air that goes into it — the airflow is about the same — and the water that goes into it ... is 45 degrees Celsius.”

At that temperature, “no water chillers are necessary for data centers,” he added. “We are basically cooling this supercomputer with hot water; it is so incredibly efficient.” Forty-five degrees Celsius is the equivalent of 113 degrees Fahrenheit.

The new Nvidia chips could scramble plans for projects that come with major price tags.

ChatGPT producer OpenAI alone has said it aims to build $1.4 trillion worth of computing capacity. Microsoft, one of OpenAI’s most critical data center partners, said in October that it plans to increase its AI computing capacity by 80% over the coming year “and roughly double our total datacenter footprint over the next two years.”

Those data centers, which have triggered controversy over their water and electricity use, require high-powered chillers to keep the equipment inside cool enough to keep running.

Chillers are so critical to data centers that in November, when the devices were accidentally knocked offline at a facility used by the trading giant CME Group, temperatures inside the data center rose too much, leading to an equipment shutdown. Systems that normally process trillions of dollars’ worth of trades in commodities and futures markets for investors from London to Hong Kong were halted for 10 hours until the cooling system could be restored.

Some industry analysts see Huang’s announcement as a potential worry for companies that have been involved with building data centers and the cooling systems they require.

“We believe the comments create some questions/concerns,” analysts at the investment firm Baird wrote Tuesday.

“We don’t see a big risk to near-term estimates, but expect news to create some incremental concerns around orders, especially later in 2026,” they wrote.

Nvidia said Monday that the next-generation Vera Rubin chips would be available for customers in the second half of 2026.

“Unsurprisingly, data centers have been a substantial area of growth for HVAC companies,” the Baird analysts wrote. Cooling companies have seen data centers as “a source of strong revenue/order activity over the past 12-18 months, benefitting not only from strong data center demand, but also greater cooling density requirements.”

Not everyone is convinced it’s a warning sign, though.

“While we understand investor concern around the end market dynamics, we view the HVAC sell-off activity ... as overdone,” Citigroup industrials analyst Andrew Kaplowitz wrote to clients, noting that the architecture of the Rubin chips “still requires liquid cooling capabilities.”

Indeed, data center infrastructure provider Vertiv Holdings shares closed fractionally higher after having fallen more than 7%. And despite Tuesday’s moves lower, Johnson Controls has still gained more than 45% over the last year.